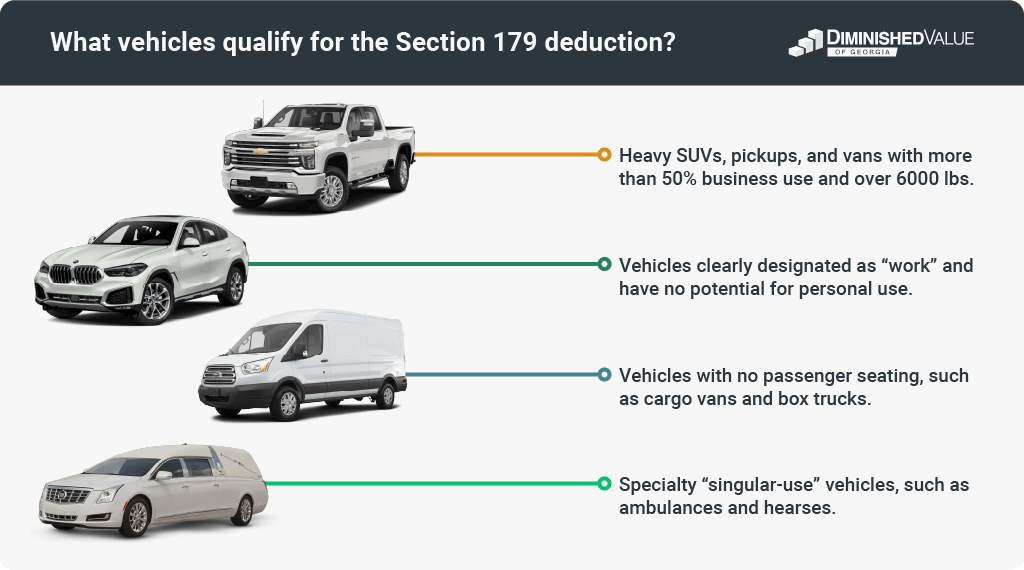

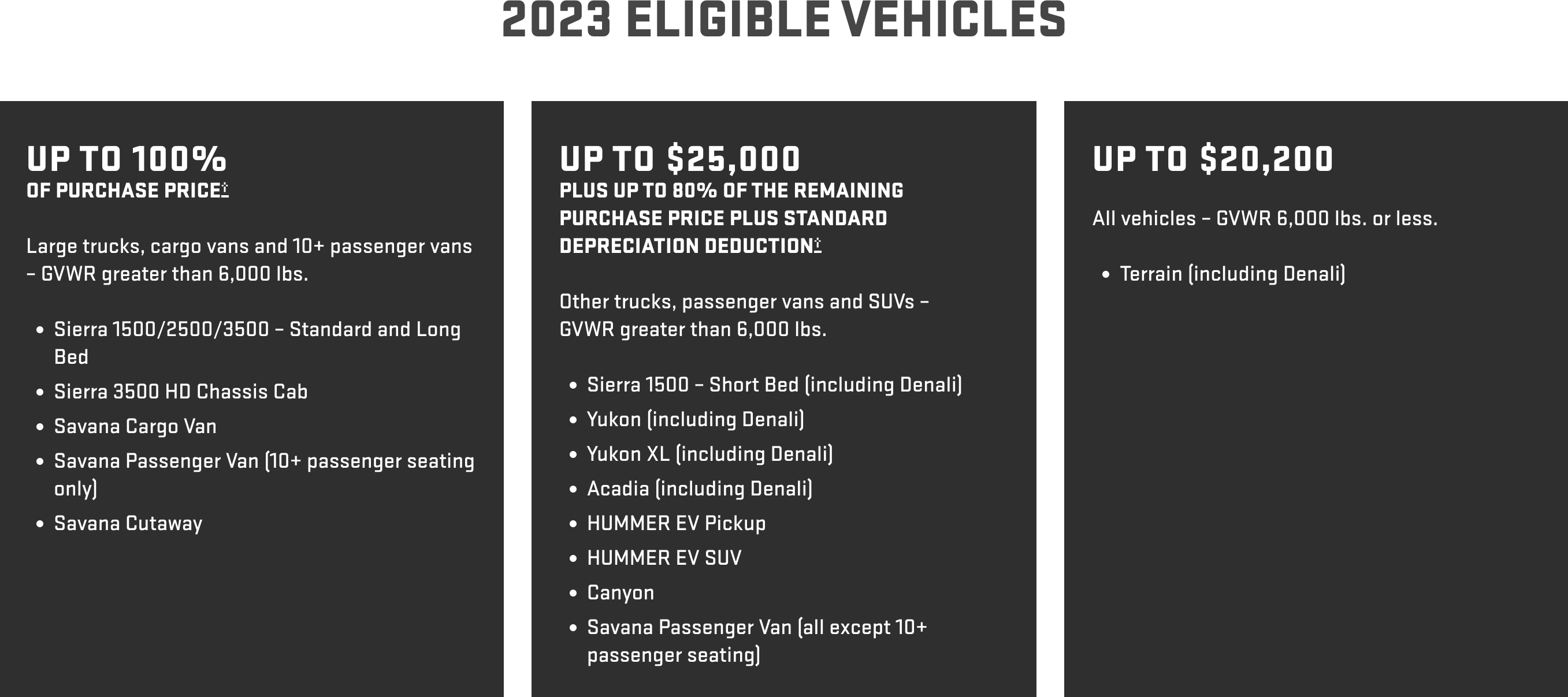

Section 179 Cars 2024 – They’re often talking about Section 179 — the “Hummer loophole,” which allows business owners who purchase heavy vehicles for work and deduct them through their business. There’s a lot more to Section . Not many people making $800 a week can afford to drive a car that leases for $1,750 a month. Mrs. Baker is no tax expert, but she has questions. Her answers may lie buried in Section 179 and the .

Section 179 Cars 2024

Source : diminishedvalueofgeorgia.comSection 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Vehicles For 2024 Balboa Capital

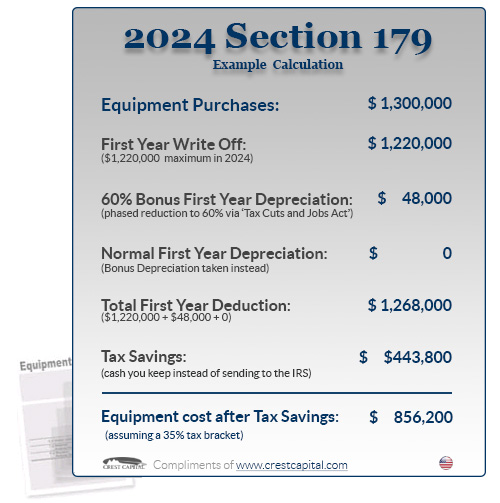

Source : www.balboacapital.comSection 179 Deduction – Section179.Org

Source : www.section179.orgUnderstanding The Section 179 Deduction Coffman GMC

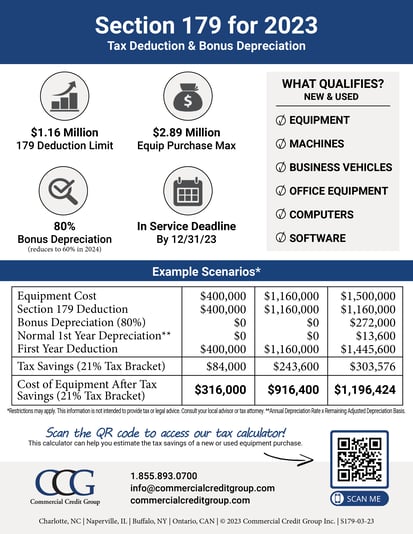

Source : www.coffmangmc.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comUnderstanding The Section 179 Deduction Coffman GMC

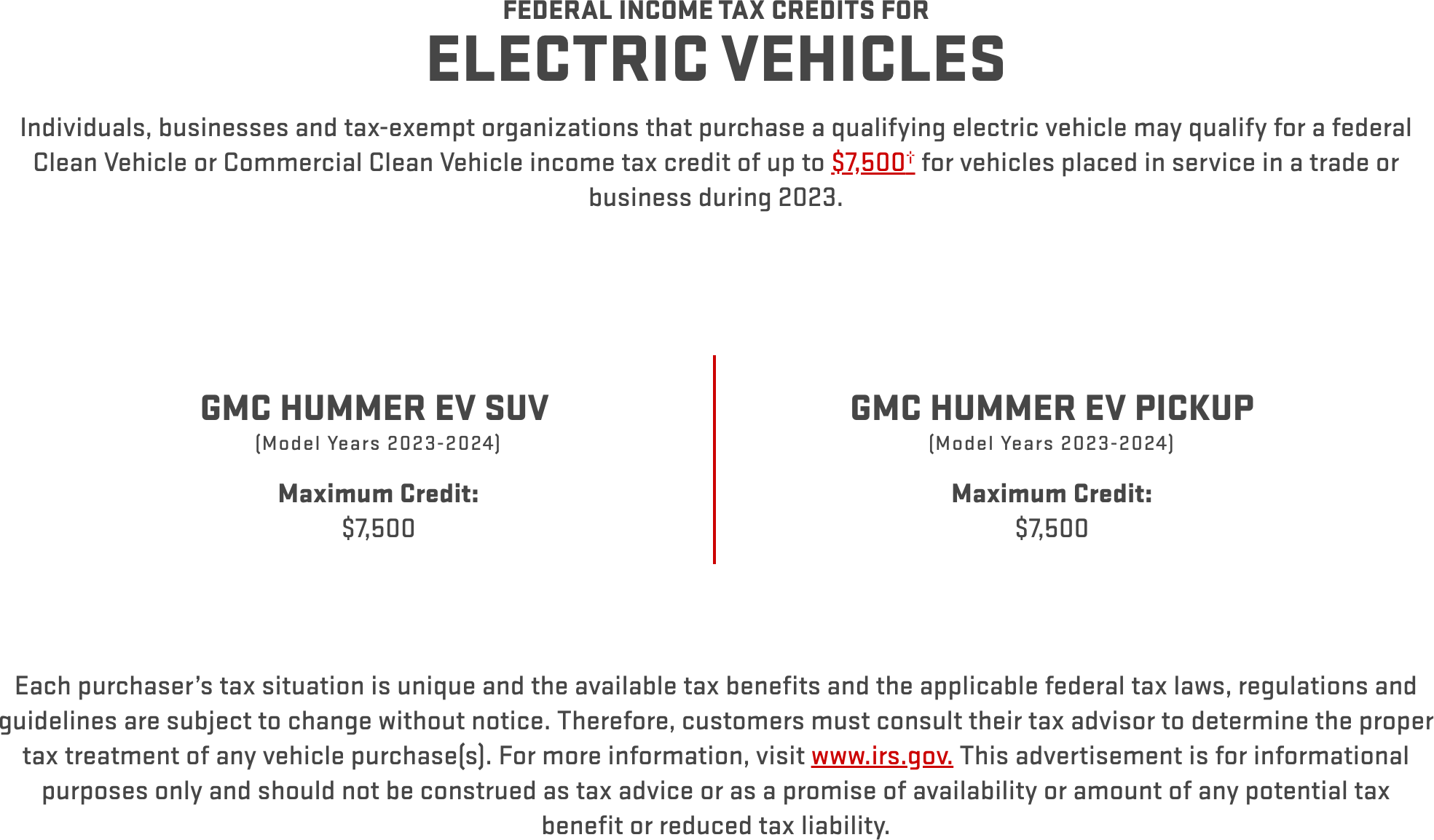

Source : www.coffmangmc.comSection 179 Cars 2024 List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : Section 179 allows businesses to deduct the full cost Other passenger vehicles, such as regular cars and SUVs, are only partially deductible. The deduction on such vehicles was capped . Section 179, which is widely used by business owners to purchase huge cars, was originally launched in 1958 to support the farmers and small business owners to purchase tractors, farm equipment .

]]>